Benue State’s domestic debt rises to N122.5 billion

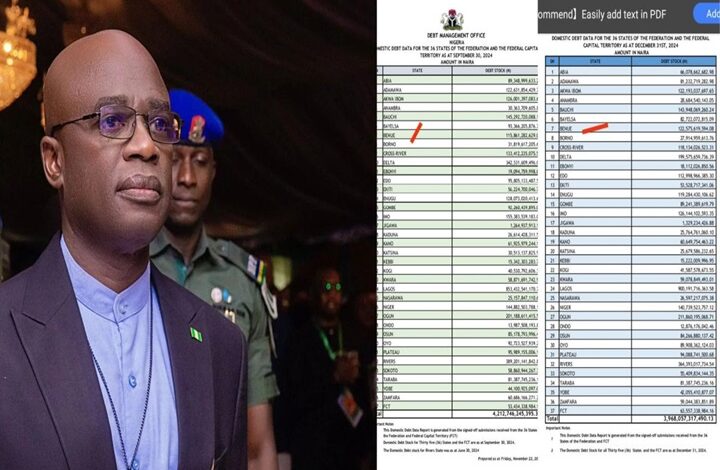

Benue State’s domestic debt has surged dramatically, reaching N122.5 billion by December 2024.

The latest data from the Debt Management Office (DMO) indicates a concerning trend.

Specifically, this data shows an increase of approximately N7 billion, rising from N115.8 billion in September 2024.

Consequently, this escalation positions Benue as the eighth most indebted state domestically in Nigeria by year-end.

On the other hand, Benue‘s foreign debt experienced a slight reduction. External obligations decreased from $26.4 million in June 2024 to $25.573 million by December 2024.

Despite this marginal improvement in foreign debt figures, the state’s overall financial burden remains significant.

In fact, Benue’s expenditure on debt servicing reached N7.4 billion in 2024, straining resources that could otherwise support critical state functions and development initiatives.

Moreover, an analysis of Benue State’s budget performance revealed alarming spending patterns.

Between January and September 2024, the state allocated a staggering N706 million for honorariums and sitting allowances.

This expenditure is equivalent to the budget required for constructing 529 boreholes, raising serious concerns over prioritization amid the state’s financial challenges.

In a broader context, Benue State’s reliance on loans mirrors a trend observed across Nigerian states.

For example, Bauchi State’s external debt rose slightly from $185.2 million in June 2024 to $186.8 million by December 2024.

However, on the domestic front, Bauchi recorded a reduction, with its debt declining from N145.2 billion in September 2024 to N143.9 billion by year-end, marking a decrease of N1.3 billion.

Nevertheless, Bauchi remains the fifth most indebted state domestically in Nigeria.

Controversial budget allocations in Bauchi State have ignited public outcry, raising questions about financial management amid economic challenges.

The state’s approved 2025 budget allocates N132 million for purchasing 32 chairs and tables, with each item priced at an astonishing N2 million.

N440 million is allocated for 20 motor vehicles for principal officers, which translates to N22 million for each vehicle.

Furthermore, the state plans to spend N118 million on two 32-seater Toyota buses, averaging N59 million each.

In addition, significant allocations include N16.8 million for seven laptop computers, averaging N2.4 million per unit.

The budget also includes N10 million for a photocopier machine designated for the offices of the Speaker and Deputy Speaker.

Moreover, six scanners are included in the budget at a total cost of N132 million, with each scanner priced at N22 million.

These expenditures have raised significant concerns among citizens and financial experts regarding potential mismanagement and misplaced priorities.

Due to Bauchi State’s ongoing fiscal challenges and rising debt profile, it is necessary to scrutinize these allocations closely.

Consequently, stakeholders must assess the effectiveness of current financial strategies to ensure sustainable economic growth and development.

As state governments increasingly depend on loans, calls for fiscal reforms and prudent financial management practices grow louder.

Experts argue that excessive borrowing without corresponding investments in sustainable development projects jeopardizes long-term economic stability.

In conclusion, as both Benue and Bauchi States grapple with mounting debts and controversial spending decisions, stakeholders urge greater transparency and accountability in budgetary processes.

This approach effectively utilizes public resources for citizens’ benefit.

Consequently, it fosters trust and promotes sustainable development in communities.

Post Views: 36