Man prosecuted for undeclared £8,020, $704 at Lagos Airport

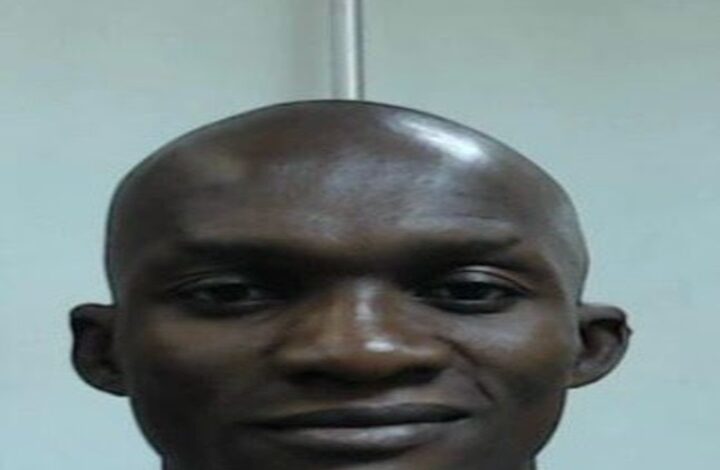

Lagos, Nigeria – April 17, 2025- The Economic and Financial Crimes (EFCC) Commission brought Agudosi Christopher Okechukwu to court for failing to declare foreign currency at Murtala Muhammed International Airport.

Justice Yellim Bogoro of the Federal High Court in Ikoyi heard the case after customs officers initially arrested Okechukwu last December.

Authorities discovered £8,020 and $704 hidden in his possession during a routine customs inspection at the airport. Following the seizure, the EFCC assumed control of the investigation under Nigeria’s Money Laundering Act. During the hearing, Okechukwu pleaded guilty, prompting prosecutors to present their evidence.

EFCC operative Abubakar Magaji testified that Okechukwu declared only £7,000 while deliberately concealing the rest. In his defense, Okechukwu claimed emotional distress due to his brother’s recent death, presenting a death certificate for review. However, Magaji countered with detailed arrest records, including Okechukwu’s initial statement and the customs handover report.

The prosecution submitted these documents as evidence, which the judge accepted and marked as exhibits. Justice Bogoro ordered Okechukwu remanded in custody while adjourning the case for final judgment in May. This prosecution reflects Nigeria’s stricter enforcement of financial regulations at entry points.

Financial crimes authorities warn travelers to comply with currency declaration laws to avoid severe penalties. Recent cases demonstrate increased scrutiny on illicit fund movements through airports and land borders. The EFCC emphasizes that full transparency remains mandatory for all inbound and outbound passengers.

Okechukwu’s trial highlights ongoing efforts to curb money laundering and illicit financial flows nationwide. Legal experts note that emotional pleas, while considered, rarely exempt defendants from prosecution under existing statutes. The court’s pending ruling will determine whether mitigating circumstances influence sentencing.

Meanwhile, financial analysts observe that consistent enforcement deters would-be offenders attempting to bypass currency controls. The EFCC continues collaborating with customs and immigration to strengthen monitoring at ports of entry. This case serves as another reminder of Nigeria’s firm stance against financial crimes.

As the May judgment date approaches, observers await the court’s decision and its broader implications for similar cases. The outcome could reinforce the government’s zero-tolerance policy or prompt discussions on balancing justice with humanitarian considerations. Regardless, authorities maintain that compliance remains non-negotiable for all travelers.

Financial regulators urge the public to stay informed on declaration requirements to avoid legal troubles. Recent campaigns by the EFCC and customs aim to educate travelers on proper procedures before departure or arrival. Such measures seek to reduce violations while maintaining robust anti-money laundering controls.

Okechukwu’s case underscores the consequences of non-compliance, regardless of personal circumstances. Legal precedents suggest strict penalties await those found guilty of deliberate financial concealment. The judiciary’s approach in this and future cases will shape Nigeria’s financial enforcement landscape moving forward.

With heightened surveillance and public awareness, authorities hope to minimize currency-related offenses across borders. The EFCC reaffirms its commitment to prosecuting violators while ensuring due process. As this case demonstrates, no exemption exists for those who bypass financial transparency laws.

Travelers must remain vigilant in adhering to regulations to prevent similar legal battles. The upcoming verdict will clarify judicial expectations for future currency declaration cases in Nigeria. Until then, enforcement agencies continue their crackdown on illicit financial activities nationwide.

Post Views: 15