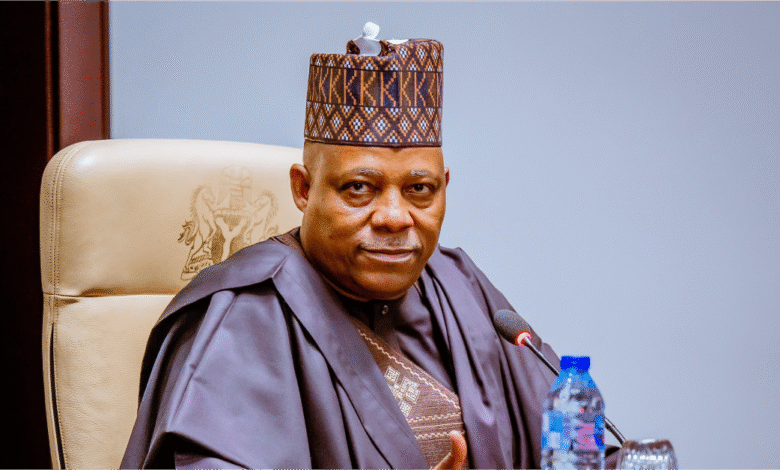

UNGA: Shettima Markets Nigeria’s $200 Billion Energy Transition Opportunity to Investors

Vice-President Kashim Shettima has showcased Nigeria’s $200 billion energy transition opportunity to investors at the ongoing 80th session of the United Nations General Assembly in New York.

Mr Shettima did this while speaking at a roundtable hosted by the Business Council for International Understanding on Monday in New York. He restated the need for “partnerships” to maximise the multi-faceted, multibillion-dollar investment opportunities across the country.

He also highlighted that Nigeria’s sovereign rating by platforms like Fitch and Moody’s implied that the country was positioned as the natural hub for the African Continental Free Trade Area’s $3.4 trillion market.

Mr Shettima drew the attention of investors worldwide to the current multibillion-dollar, multifaceted economic resets across Nigeria, as embodied by President Bola Tinubu’s Renewed Hope Agenda.

He noted that Nigeria is West Africa’s largest economy and Africa’s largest consumer market, with a current population of 236 million, projected to reach 320 million by 2040.

Beyond being a demographic giant with a median age of approximately 17, more than 58 per cent of whom are under 30, he said, Nigeria is home to one of the world’s deepest talent pools.

“When you add to this our geographic position as a natural hub for trade between Africa, the Americas, and Asia; our 44 distinct natural resources; our five tech unicorns; the largest oil reserves in Africa; and 210 trillion cubic feet of proven gas reserves, you see that Naija no dey carry last,” he added.

Mr Shettima told the global audience that since mid-2023, under Mr Tinubu’s Renewed Hope Agenda, Nigeria had embarked on one of the boldest economic resets in its history.

He said the unification of Nigeria’s exchange rates, the removal of decades-old fuel subsidies, the modernisation of Nigeria’s tax and customs regimes, among others, were shining examples of the Renewed Hope reforms.

“This reset includes the full implementation of AfCFTA, the roll-out of a National Single Window for trade, a new Investment and Securities Act, an upgraded PPP framework, and modernising bilateral investment treaties.

“The results are already visible. Our GDP growth is accelerating, our external reserves are strengthening, and inflation is moderating. This is why investor commitments are also rebounding,” he said.

Mr Shettima noted that in April, Fitch upgraded Nigeria’s sovereign rating to B with a stable outlook, and Moody’s lifted its issuer rating to B3 with a stable outlook. He said the two rating platforms cited Nigeria’s improved buffers and clearer policy direction as their barometer,

He said in Nigeria’s Special Economic Zones, the Federal Government offers duty-free imports, rent concessions, rebates on non-oil export proceeds, and integrated logistics platforms that unlock working capital for exporters

Nigeria’s Special Agro-Industrial Zones, he said, were reducing post-harvest losses by up to forty per cent and linking farmers directly to processing and export hubs. According to him, they are also transforming Nigeria from a fragmented producer into a continent-scale food system serving millions across West Africa.

He stressed that fiscal incentives and VAT waivers were de-risking investment in both traditional and renewable power assets, from gas-fired independent power plants to off-grid solar and clean hydrogen pilots.

Mr Shettima said the government was blending sovereign and private finance to fund metro lines, dry ports, and industrial corridors, building the backbone of West African trade and creating long-term revenue streams for investors.

(NAN)