Ekiti records 30.1% surge in external debt, reaches $31.1Mn

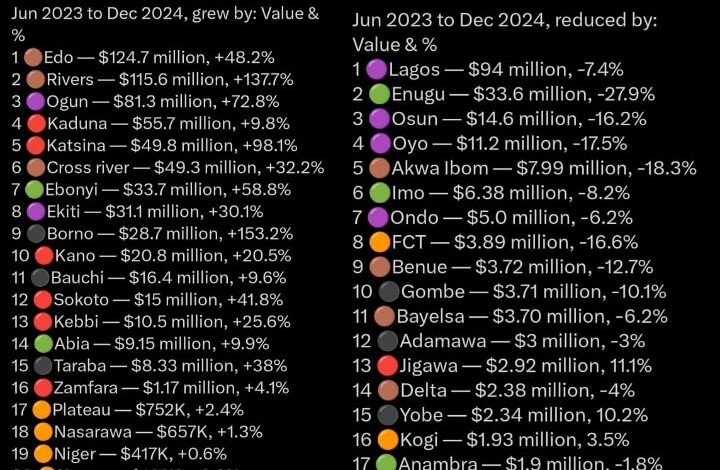

April 25, 2025- Ekiti State’s external debt surged by 30.1% between June 2023 and December 2024, reaching $31.1 million, according to Statisense.

This spike mirrors broader national debt trends, positioning Ekiti eighth among 20 Nigerian states with rising external liabilities.

Meanwhile, Borno State’s external debt skyrocketed 153.2%, while Rivers State’s climbed 137.7%, reflecting acute fiscal pressures across regions.

Conversely, Lagos State slashed its debt by $94 million (7.4%), leading states demonstrating fiscal restraint.

Enugu reduced obligations by $33.6 million, Osun by $14.6 million, and Oyo by $11.2 million.

These diverging trends highlight stark contrasts in financial management, raising concerns about uneven policy effectiveness nationwide.

Statisense’s data underscores Nigeria’s fractured economic health as debts balloon in some regions while others achieve stability.

Critics argue rising debts threaten public services and long-term growth, particularly in high-borrowing states like Ekiti.

Conversely, debt-reducing states showcase proactive measures, such as Lagos’s revenue diversification and cost-cutting.

However, analysts warn unchecked borrowing could strain federal relations, as struggling states may seek bailouts.

Simultaneously, citizens demand transparency, urging governments to justify loans through visible infrastructure or social projects.

As debates continue, stakeholders emphasize the need for standardized fiscal frameworks to curb reckless borrowing.

Economists suggest stricter oversight, citing examples like Enugu’s debt audits or Osun’s austerity programs.

Meanwhile, Ekiti faces mounting scrutiny over its spending priorities, with officials attributing the increase to critical infrastructure investments.

Yet, skepticism persists amid Nigeria’s sluggish economic growth and volatile exchange rates.

Moving forward, state governments must balance urgent development needs with sustainable debt practices.

While Lagos sets a benchmark, high-debt states risk austerity traps without federal support or improved revenue streams.

The coming months will test whether Nigeria’s fiscal disparities widen further or prompt unified reforms.

For now, Ekiti’s 30.1% hike symbolizes both local challenges and a national crossroads demanding immediate action.

Post Views: 52