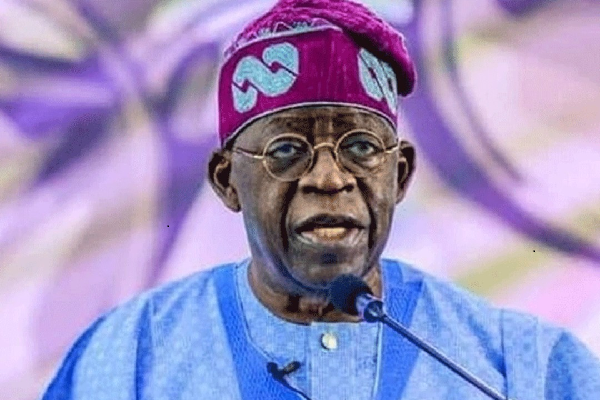

JUST IN: Tinubu Orders FEC to Crash Food Prices Nationwide

(DDM) – Nigeria’s local currency recorded renewed strength on Monday across both the parallel foreign exchange market and the official NAFEM trading window.

Diaspora Digital Media (DDM) gathered that in Abuja, the naira exchanged at ₦1,515 per dollar for buying and ₦1,525 for selling.

This represents a slight improvement compared to Friday’s closing average of ₦1,530 in the black market.

At the Nigerian Autonomous Foreign Exchange Market (NAFEM), the naira closed firmer at ₦1,514 to the dollar.

This also reflects an appreciation from last week’s ₦1,521 closing rate.

Market watchers say the currency has shown signs of resilience in recent weeks.

They attribute this to Central Bank interventions, liquidity management, and policy measures targeting speculative activity.

However, experts caution that the underlying pressures on the currency remain unresolved.

Dollar scarcity continues to affect supply across different trading platforms.

Speculative demand by individuals and businesses seeking to hedge against future volatility is also fuelling pressure.

In addition, analysts highlight uncertainty in the Central Bank’s broader policy direction.

They argue that while short-term gains have been recorded, the foundation for long-term recovery is still shaky.

Nigeria’s economy has battled severe exchange rate instability since the currency was floated in mid-2023.

The policy shift aimed to unify multiple exchange rate windows and attract foreign investment.

Instead, it triggered heavy volatility, leading to sharp depreciation in subsequent months.

The naira reached record lows earlier in 2024 before a series of interventions halted the free fall.

Despite these efforts, businesses and households continue to face high costs of imports.

Inflationary pressures remain elevated, with food and fuel prices rising across the country.

Experts argue that stability in the forex market is critical to restoring investor confidence.

Foreign portfolio inflows have been inconsistent due to global uncertainties and local risks.

Some economists believe Nigeria needs stronger reforms beyond Central Bank actions.

They recommend diversifying exports, boosting oil production, and encouraging non-oil foreign earnings.

They also emphasize fiscal discipline and transparency in government spending.

Without such measures, the sustainability of the naira’s appreciation remains doubtful.

The Central Bank has yet to outline a clear medium-term roadmap for exchange rate management.

Market participants continue to monitor developments closely, awaiting signals that stability will be more than temporary.

For many Nigerians, the strength of the naira is directly tied to the cost of living.

Ordinary citizens hope that the latest appreciation translates to lower prices of imported goods.

Traders, however, remain cautious, noting that price adjustments in the market are often slow and uneven.

Financial experts conclude that while Monday’s gain is encouraging, Nigeria’s forex battle is far from over.

The naira’s future, they stress, depends on deeper economic reforms and consistent policy execution.

Post Views: 171