Strategic shifts, technological innovation will be key for growth in maturing payments industry |

Boston Consulting Group (BCG)’s 22nd annual Global Payments Report, has highlighted the urgent need for decisive action to ensure profitable and sustainable long-term growth in the payments industry. The report, titled Fortune Favors the Bold, emphasises the strategic imperative for payments companies to navigate mounting challenges from evolving customer expectations, regulatory scrutiny, investor priorities, and technological disruptions.

The payments industry, once the poster child for a rapid growth sector, is now under pressure as investor expectations shift toward profitability and differentiated business models. With growth rates slowing sharply across North America and Europe, firms wanting to remain competitive in the payments space need to reshape their strategies, modernise their technology, and embrace generative AI (GenAI).

“The payments industry is entering a new phase, and the days of easy secular growth are behind us. Firms will need to embrace bold capital allocation and portfolio strategies to deliver industry-leading shareholder returns,” said Inderpreet Batra, Managing Director and Senior Partner at BCG and coauthor of the report. “They must leverage new technologies like GenAI, modernise their tech, and enhance their risk and compliance frameworks.”

Key findings from the report include:

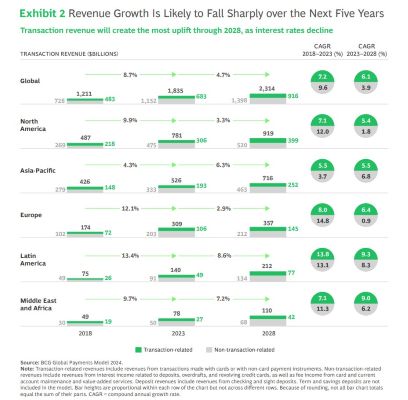

Growth is slowing across regions: Global payments revenue growth is projected to halve, rising at a 5% compound annual growth rate (CAGR) through 2028 to create a revenue pool worth $2.3 trillion. This is significantly lower than the 9% CAGR from the previous five years, which drove the global revenue pool to $1.8 trillion in 2023. North America and Europe will see the most dramatic declines in growth, with projected annual revenue increases of about 3%.

Asia-Pacific remains a growth driver with 6% growth per year, fuelled by increasing digital payments adoption and the rise of middle-class consumers. Higher annual growth rates are also expected in Latin America and the Middle East at 9% and Africa at 7%, driven by accelerating digital payments in emerging markets.

Also Read

The 7% regional outlook for Africa can be attributed to factors such as population growth and political stability. The expectation is that this will lead to the continent’s payments sector expansion, led mainly by the continued acceleration of digital payments, which in turn will have a positive knock-on effect on other sectors including insurance and mobile banking.

In established markets like the US, UK, and Nordic countries, the shift from cash to digital is nearing its peak. Here the transition to digital payments is almost complete, with less than 10% of consumer transactions by value still made in cash. Even traditionally cash-reliant markets such as Germany have seen a sharp decline, with the value of cash transactions in store dropping from 50% in 2010 to approximately 25% in 2023. The digital payments market is reaching maturity, slowing the opportunity for further rapid growth in non-cash transaction volumes.

Historically, revenue growth in other markets was the primary driver of shareholder return in the payments sector. Between 2016 and 2021, revenue growth contributed to over 55% of total shareholder returns (TSR). However, from 2021 to mid-2024, this dynamic shifted, with revenue growth, profit growth, and multiple expansion playing an equal role in driving TSR. During this period, buybacks, dividends, and other capital return strategies gained significance, and now account for about 36% of TSR. Investor profiles have evolved as well: 33% of the payments industry’s investor base is now value-focused (up from 26% in 2021) and expectations for tangible value in dividends, buybacks, and capital returns have sharpened.

Instant payments and digital currencies are reshaping the payments landscape: Real-time payments systems are revolutionising how transactions are processed and making it essential for payments players to anticipate higher adoption by shaping relevant solutions and preparing their back office to be operationally ready. The rise of central bank digital currencies (CBDCs) is poised to further disrupt the industry, with programmable payments offering new use cases and additional efficiency in financial transactions. Adoption of these technologies could significantly reshape traditional payments and the overall payments ecosystem.

Generative AI is expected to revolutionise the payments industry. Early movers are already using it to boost customer service, improve operational efficiency, and enhance fraud detection. Companies that hesitate risk falling behind as GenAI will soon become a competitive necessity. Payments players must invest at once in AI capabilities to improve the customer experience, streamline their operations, and create personalised experiences at scale before the window of opportunity closes.

The payments leaders of the future will need a rationalised, cloud-based, modular technology architecture to remain resilient and cost-efficient. By transitioning to scalable systems in a modernising market infrastructure, companies can reduce tech debt, cut operating costs, and bring products to market more quickly. Leading firms are already leveraging modern cores to streamline operations and maintain competitive advantages through continuous innovation.

“As the payments sector reaches a critical turning point, those who act decisively now will emerge as the clear leaders,” said Markus Mansberger, Managing Director and Partner at BCG. “The companies that embrace bold product innovation and technology modernisation today will not only shape the future of the industry but also deliver lasting value to both their customers and shareholders.”

Post Views: 4